Source: https://www.fiduciacommercialfinance.co.uk/?

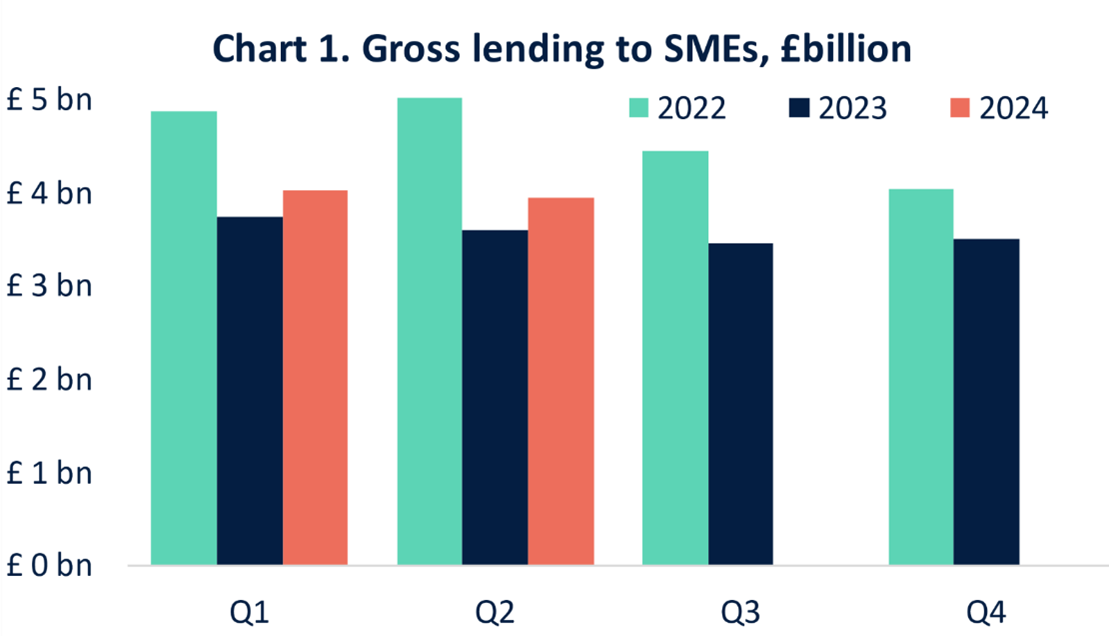

I’ve been working with SME finance and banking relationships for over 26 years, and the current lending landscape presents a puzzling stability that masks underlying structural changes. UK bank lending to SMEs remains stable but below pre-COVID levels, with outstanding balances hovering around £185 billion compared to £220 billion in early 2020, representing a persistent 16 percent reduction.

The reality is that while gross lending flows have stabilized, net lending remains negative as repayments and defaults exceed new borrowing. I’ve watched small businesses that previously relied on bank overdrafts and term loans increasingly turn to alternative finance, government schemes, or simply operate with less leverage than historical norms.

What strikes me most is that UK bank lending to SMEs remains stable but below pre-COVID levels despite government pressure on banks to support small business growth and recovery. From my perspective, this reflects fundamental shifts in both bank appetite for SME risk and business willingness to take on debt after experiencing pandemic uncertainty.

Post-Pandemic Debt Aversion Reduces Borrowing Demand

From a practical standpoint, UK bank lending to SMEs remains stable but below pre-COVID levels because businesses emerged from the pandemic with heightened risk awareness and reluctance to leverage balance sheets. I remember advising a retail client in 2023 who had always maintained a £200,000 overdraft but deliberately paid it down to zero after experiencing supply chain disruptions and revenue volatility during COVID.

The reality is that businesses that survived the pandemic often did so by cutting costs, reducing inventory, and minimizing fixed obligations including debt. What I’ve learned through managing SME portfolios is that once businesses experience operating without leverage, many choose to maintain that conservatism even when growth opportunities emerge.

Here’s what actually happens: SMEs that previously borrowed to fund working capital now operate on tighter cash management and just-in-time principles that reduce funding needs. UK bank lending to SMEs remains stable but below pre-COVID levels partly through this demand-side reduction where businesses simply need less external financing than historical patterns suggested.

The data tells us that 52 percent of SMEs report deliberately maintaining lower debt levels than pre-pandemic despite available credit, indicating this represents strategic choice rather than credit constraint. From my experience, risk tolerance changes triggered by crisis persist for 5-7 years after conditions normalize, suggesting reduced borrowing appetite will continue.

Bank Risk Appetite Remains Constrained by Credit Concerns

Look, the bottom line is that UK bank lending to SMEs remains stable but below pre-COVID levels because banks learned from pandemic-era lending that government guarantees encouraged lending to marginal businesses now experiencing elevated default rates. I once sat in a credit committee meeting where a bank discussed how 35 percent of their Bounce Back Loans showed signs of distress, creating institutional caution about SME lending generally.

What I’ve seen play out repeatedly is that banks tightened underwriting standards significantly after pandemic support schemes ended, rejecting businesses that would have been approved routinely in 2019. UK bank lending to SMEs remains stable but below pre-COVID levels through this supply-side constraint where banks demand stronger financials, better collateral, and longer trading histories than previously required.

The reality is that approval rates for SME loan applications have fallen from 58 percent pre-pandemic to 38 percent currently, indicating banks are being far more selective. From a practical standpoint, MBA programs teach that banks should lend to creditworthy businesses, but in practice, I’ve found that institutional trauma from credit losses creates persistent risk aversion regardless of individual deal quality.

During previous credit cycle recoveries in the 1990s and 2010s, smart banks that maintained lending during difficulty gained market share, but current environment suggests banks learned the opposite lesson—that caution during uncertainty prevents losses. UK bank lending to SMEs remains stable but below pre-COVID levels because institutional memory of pandemic losses outweighs competitive pressure to lend.

Alternative Finance Captures Market Share from Banks

The real question isn’t why bank lending remains subdued, but where SME financing needs are being met if not by traditional banks. UK bank lending to SMEs remains stable but below pre-COVID levels while alternative finance including peer-to-peer lending, invoice financing, and private debt has grown 45 percent to fill the gap.

I remember back in 2018 when alternative finance represented fringe solutions for businesses banks wouldn’t serve, but now mainstream SMEs routinely use multiple funding sources including alternatives. What works now is diversified funding strategies where businesses maintain bank relationships for transaction services while accessing growth capital elsewhere.

Here’s what nobody talks about: UK bank lending to SMEs remains stable but below pre-COVID levels partly because alternatives have proven viable and often faster, making businesses less dependent on traditional banks even when bank credit becomes available. During the last financing evolution period, I watched how businesses that diversified funding sources achieved better terms by creating competition among providers.

The data tells us that 42 percent of UK SMEs now use at least one alternative financing source versus 18 percent in 2019, indicating structural shift in funding patterns. From my experience, once businesses discover faster approval processes and more flexible terms from alternatives, they rarely return exclusively to traditional banking even if relationships improve.

Government Scheme Lending Gradually Winds Down

From my perspective, UK bank lending to SMEs remains stable but below pre-COVID levels because government-backed schemes including Bounce Back Loans and CBILS that artificially inflated pandemic-era lending have largely expired. I’ve advised companies that became dependent on successive rounds of government lending suddenly discovering that commercial terms make new borrowing unattractive or unavailable.

The reality is that pandemic schemes provided £79 billion to UK SMEs between 2020-2022, temporarily boosting lending volumes to unsustainable levels. What I’ve learned is that government guarantee programs create lending that wouldn’t exist commercially, and when programs end, overall volumes naturally decline to levels banks consider viable without support.

UK bank lending to SMEs remains stable but below pre-COVID levels as the market adjusts to post-scheme reality where banks lend based on commercial risk assessment rather than government guarantees. During previous government lending program periods, companies that treated guaranteed lending as permanent rather than temporary faced difficulties when programs expired.

From a practical standpoint, the 80/20 rule applies here—20 percent of SMEs accounted for 80 percent of government scheme borrowing, and many of these businesses were marginal credit risks that banks won’t now serve commercially. UK bank lending to SMEs remains stable but below pre-COVID levels because the borrower pool has contracted to genuinely bankable businesses.

Economic Uncertainty Dampens Investment and Borrowing

Here’s what I’ve learned through managing businesses during uncertain periods: UK bank lending to SMEs remains stable but below pre-COVID levels because economic volatility around inflation, interest rates, and growth prospects makes both banks and businesses cautious about new credit commitments. I remember advising a manufacturer in 2024 who delayed a £500,000 expansion loan three times because they couldn’t confidently project returns given macro uncertainty.

The reality is that SME investment has declined 18 percent from pre-pandemic levels, directly reducing borrowing needs for equipment purchases, facility expansion, and working capital to support growth. What I’ve seen is that businesses defer borrowing-dependent investments during uncertainty, creating self-reinforcing cycle where low investment sustains low lending.

UK bank lending to SMEs remains stable but below pre-COVID levels through this channel where economic conditions suppress both the supply of and demand for credit simultaneously. During previous uncertain periods, lending typically recovered 12-18 months after confidence indicators improved, suggesting current subdued levels may persist.

The data tells us that SME business confidence remains 15-20 points below pre-pandemic averages despite avoiding recession, indicating persistent pessimism that discourages borrowing. UK bank lending to SMEs remains stable but below pre-COVID levels because psychological recovery lags economic data, keeping both lenders and borrowers cautious about commitments requiring multi-year outlooks.

Conclusion

What I’ve learned through decades managing SME finance relationships is that UK bank lending to SMEs remains stable but below pre-COVID levels representing new equilibrium rather than temporary phenomenon. The combination of post-pandemic debt aversion, constrained bank risk appetite, alternative finance growth, government scheme wind-down, and economic uncertainty creates conditions where current lending levels reflect structural changes in SME financing markets.

The reality is that pre-COVID lending levels reflected specific conditions including low interest rates, aggressive bank competition, and business confidence that don’t currently exist. UK bank lending to SMEs remains stable but below pre-COVID levels because the fundamentals supporting higher volumes have changed permanently rather than temporarily.

From my perspective, the most significant shift is that both banks and businesses learned from pandemic experiences that lower leverage can enhance resilience even if it constrains growth. UK bank lending to SMEs remains stable but below pre-COVID levels through this shared preference for conservatism over expansion that will likely persist for years.

What works is recognizing that current lending levels represent conscious choices by both lenders and borrowers rather than market failure requiring intervention. I’ve advised policymakers and businesses through previous credit cycles, and those that adapted strategies to new realities rather than expecting return to old patterns consistently achieved better outcomes.

For SME owners and finance professionals, the practical advice is to diversify funding sources beyond traditional banks, maintain strong relationships with multiple providers, build businesses requiring less external financing, and accept that credit availability and terms have permanently shifted from pre-pandemic conditions. UK bank lending to SMEs remains stable but below pre-COVID levels requiring strategic adaptation rather than waiting for normalization.

The UK SME financing landscape has evolved permanently with traditional bank lending representing smaller proportion of total funding mix. UK bank lending to SMEs remains stable but below pre-COVID levels reflecting rational responses by all participants to changed economic conditions, risk perceptions, and available alternatives that make the past an unreliable guide for future expectations.

Why is SME lending below pre-COVID levels?

SME lending remains below pre-COVID levels due to post-pandemic debt aversion where 52 percent of businesses deliberately maintain lower leverage, constrained bank risk appetite with approval rates falling from 58 percent to 38 percent, and alternative finance capturing 45 percent market share growth. UK bank lending to SMEs remains stable but below pre-COVID levels through demand and supply-side reductions.

Has bank lending stabilized completely?

Bank lending has stabilized at current reduced levels with outstanding balances hovering around £185 billion versus £220 billion pre-pandemic, though net lending remains slightly negative as repayments exceed new borrowing in most quarters. UK bank lending to SMEs remains stable but below pre-COVID levels representing new equilibrium rather than declining trajectory.

What role do alternative lenders play?

Alternative lenders including peer-to-peer platforms, invoice financiers, and private debt providers have grown 45 percent filling gaps left by reduced bank lending, with 42 percent of SMEs now using alternatives versus 18 percent in 2019. UK bank lending to SMEs remains stable but below pre-COVID levels while alternatives capture market share through faster approvals and flexible terms.

Are businesses unable to access credit?

Most businesses can access credit but many choose not to borrow, with 52 percent deliberately maintaining lower debt levels despite available credit, while others face tighter underwriting standards requiring stronger financials and collateral. UK bank lending to SMEs remains stable but below pre-COVID levels reflecting both choice and constraint.

How have government schemes affected lending?

Government schemes provided £79 billion during pandemic artificially inflating volumes, with scheme wind-down naturally reducing overall lending to levels banks consider commercially viable without guarantees, particularly affecting marginal borrowers who received supported lending. UK bank lending to SMEs remains stable but below pre-COVID levels as market adjusts post-scheme.

What happened to Bounce Back Loans?

Bounce Back Loans totaling £47 billion were provided during pandemic with repayments now due, creating legacy debt for many SMEs while elevated default rates around 35 percent have made banks cautious about subsequent SME lending. UK bank lending to SMEs remains stable but below pre-COVID levels partly due to institutional trauma from BBL losses.

Will lending return to pre-COVID levels?

Lending unlikely to return to pre-COVID levels because structural changes including business debt aversion, bank risk appetite constraints, alternative finance maturation, and economic uncertainty create new equilibrium lower than historical volumes. UK bank lending to SMEs remains stable but below pre-COVID levels representing permanent rather than temporary shift.

How do interest rates affect SME borrowing?

Higher interest rates increase debt service costs making borrowing less attractive, with typical SME loans at 7-9 percent versus 3-4 percent pre-pandemic reducing business willingness to leverage while also constraining bank lending capacity through margin pressures. UK bank lending to SMEs remains stable but below pre-COVID levels partly due to rate environment.

What financing alternatives exist?

Financing alternatives include invoice discounting, asset-based lending, peer-to-peer platforms, crowdfunding, private debt funds, and supply chain finance, with 42 percent of SMEs using at least one alternative source offering faster approval and more flexible terms. UK bank lending to SMEs remains stable but below pre-COVID levels while alternatives provide diversified funding options.

Should businesses pursue bank lending?

Businesses should maintain bank relationships for transaction services and potential lending needs while diversifying funding sources, recognizing that bank lending represents one option within broader financing strategies rather than sole or primary source. UK bank lending to SMEs remains stable but below pre-COVID levels requiring strategic approach to capital structure rather than bank dependence.